Looking for an ACP? Have No Importer in Japan? We are Here to Help You!

Alcohol Beverages

How To Import Alcohol Beverages

Liquor Tax Act and Food Sanitation Act

Alcohol beverages cannot be imported by non-resident importers, and only licensed traders located in Japan can import them.

Import customs and quarantine are relatively simple, but requires alochol tax in addition to regular import duty and VAT, depending on the manufacturing method and alcoholic proof. Importers will be responsible for the products, and mush show their name and contact information on the labels.

It is important to note that alcohol beverages require sales license as well, which is not given to non-resident companies. Thus, sales have to be done by Japanese companies, and in many cases the importer handle all the process from import to sales on behalf of the seller.

Import License Not Available for Overseas Entities

Submitting food import notification and obtaining alcohol license require business registration in Japan, thus overseas entities are not allowed to import alcohol beverages if they don't have location or residency in Japan. Please look for a licensed importer to sell alcohol in Japan.

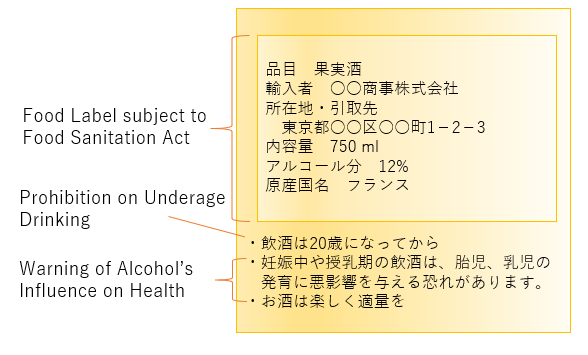

Labeling

Alcohol beverages must come with labels stating the ingredients, importer and other information required under Food Sanitation Act and Liquor Tax Act in Japan.

Information specifically required on alcohol beverage cans and bottles.

a. Importer name

b. Importer address

c. Place of transaction (the address specified in the alcohol sales license)

d. Content (l, ml. etc.)

e. Type of alcohol (beer, fruit liquor, etc.)

f. Alcoholic proof (%)

g. effervescence if applicable (sparkling or carbonated)

h. Food additives (name of the antioxidant or synthetic preservatives)

i. Warning on underaged drinking,

j. recycling marks (steel can, aluminum can, PET, paper, plastic, etc.)

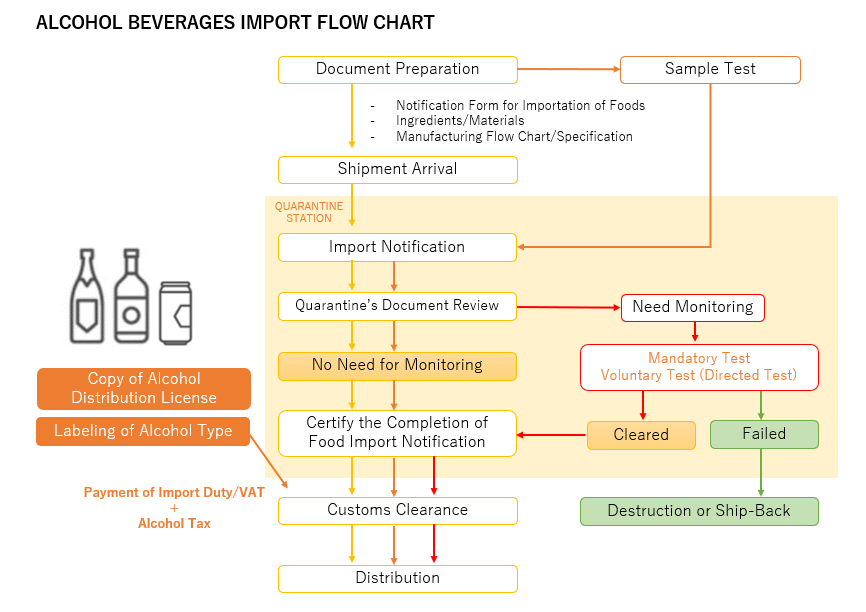

Import Process

Liquor Tax

Liquor tax is charged in addition to import duty and VAT.

| Type | Duty | Liquor Tax | |

|---|---|---|---|

| Sparkling Beverages | Beer | Duty Free | 220,000 JPY /kl |

| Law-malt Beer | *1 | 134,250 ~ 220,000 JPY/Kl (varies by the malt content and alcoholic proof) | |

| Other Sparkling Beverages (less than 10% alcohol) | *1 | 80,000 JPY/kl | |

| Brewed Beverages | Wines or Fruit wines | 15% or 125 JPY/l , whichever is the less , subject to a minimum customs duty of 67 JPY/l. | 80,000 JPY/kl |

| Distilled Liquor | Whisky, Brandy, Spirits (less than37% alcohol) | *1 | 370,000 JPY/kl |

| Mixed Liquor | Liqueur, Sweet Fruit Wine, Powdered Liquor, etc (less than 13% A) | *1 | 120,000 JPY/kl |

*Respective tariff rates differ depending upon the sort etc. of importing goods.

Expected Costs

Food Import Notifiction and Other Customs Service Fees: from 50,000 to~200,000 JPY

Testing Cost: 20,000 JPY or above /substance

Alcohol Retail License

Sales license is required to retail alcohol in any form including internet or consignment sales. Such license is only granted to companies registered in Japan, and won't be given to overseas companies. This applies to FBA(Fulfilment By Amazon) sellers and you can't list alcohol beverages there if you don't have an alcohol retail license.

Contact Us for Any Questions

お気軽にお問合せください

Call Us at お電話でのお問合せ

Contact us 24 hours via the form below.

問合せフォームは24時間受け付けております。お気軽にご連絡ください。

Updates 新着情報

2023年10月1日の関税法基本通達改正に従い、記載内容を一部更新しました。

Our column page “Customs Specialist Eyes” is updated.

コラムを更新しました。

Our column page “Customs Specialist Eyes” is updated.

コラムを更新しました。

We’re now on Amazon SPN/Service Provider Network.

当ページ運営会社が、Amazon SPN(サービスプロバイダーネットワーク)に登録されました。

ホームページを公開しました