Looking for an ACP? Have No Importer in Japan? We are Here to Help You!

Taxation on Non-Resident Importers

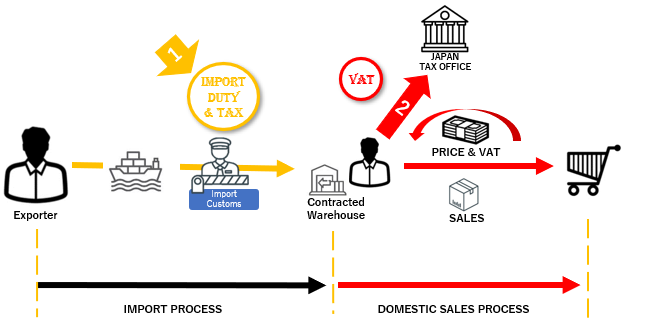

Imagine what taxes Japanese importers pay when they import goods and sell them in Japan. They pay customs duty and VAT, which is called Consumption Tax in Japan at the time of import. When they sell goods, they receive VAT from their customers and file the same to the tax office as annual tax return.

These obligations apply to non-resident importers as well. In this section, we will look at these two phases of taxation to help you become ready for your business expansion in Japan.

Taxation at the Time of Import

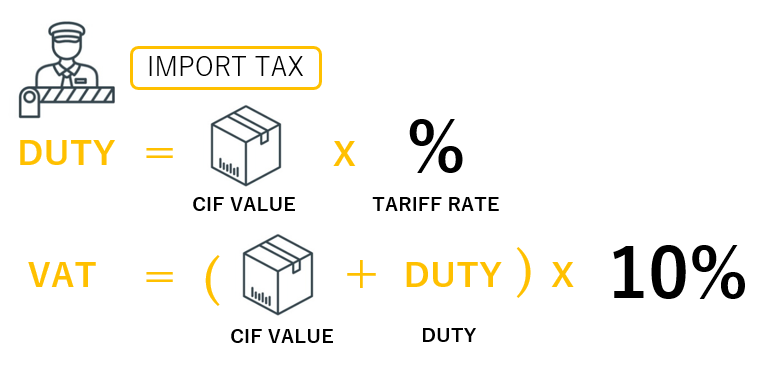

Whether resident or non-resident in Japan, any importer importing their goods to Japan has to pay import taxes. Import taxes consist of customs duties and VAT, which is called consumption tax in Japan.

Customs duty rates vary by the products, and taxes are approximately calculated as follows:

Duty = CIF x Tariff Rate

VAT = (CIF + Duty) x 10 %

Imagine you’re importing the following products to Japan

CIF value = 100,000 JPY

HS Code 6404.11(sports shoes), Made in China. WTO rate = 8%

Duty = CIF x Tariff Rate = 100,000 JPY x 8% = 8,000 JPY

VAT = (CIF + Duty) x 10 % = (100,000 + 8,000) x 10% = 10,800 JPY

Total Tax = 18,800 JPY

Customs Value

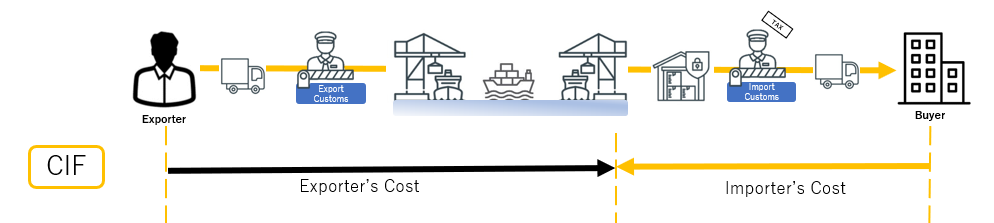

Import taxes shall be basically calculated on the CIF values.

If the import is made before the establishment of a sales transaction, or if the import is not for the purpose of sales in the first place , they do not have any specific import values. In those cases, customs apply other calculation methods to make quasi CIF value. When you should check which calculation method can be applied, you can consult with the customs office through ACP as well as the customs broker arranged by yourself. Thus, it is important to choose a professional ACP with sufficient knowledge and experience about customs process.

VAT on Sales In Japan After Import

When you import goods in Japan, you have one more tax obligation in addition to the import tax, which is the VAT (consumption tax) on your sales in Japan.

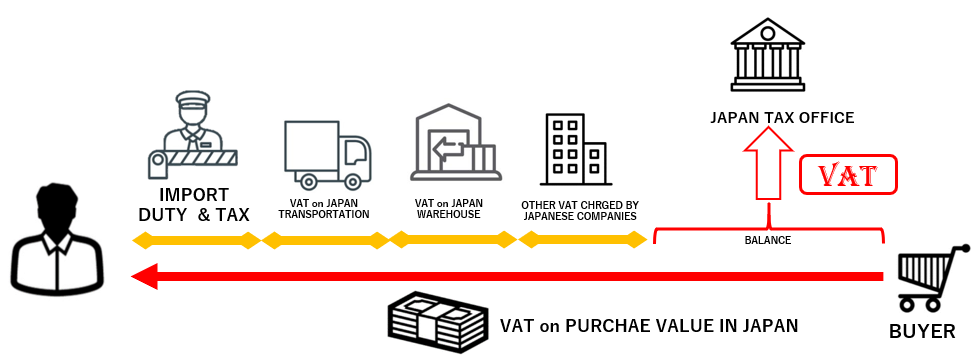

When you sell goods in Japan, you top up 10% VAT(consumption tax) on your prices. Thus, you receive 10% tax, in addition to their own prices. On the other hand, you pay VAT at the time of import, and any other service that you receive in Japan(logistics, warehouse, promotional fees, etc.). Therefore, you file and pay the balance between the VAT you have received, and the VAT you have paid.

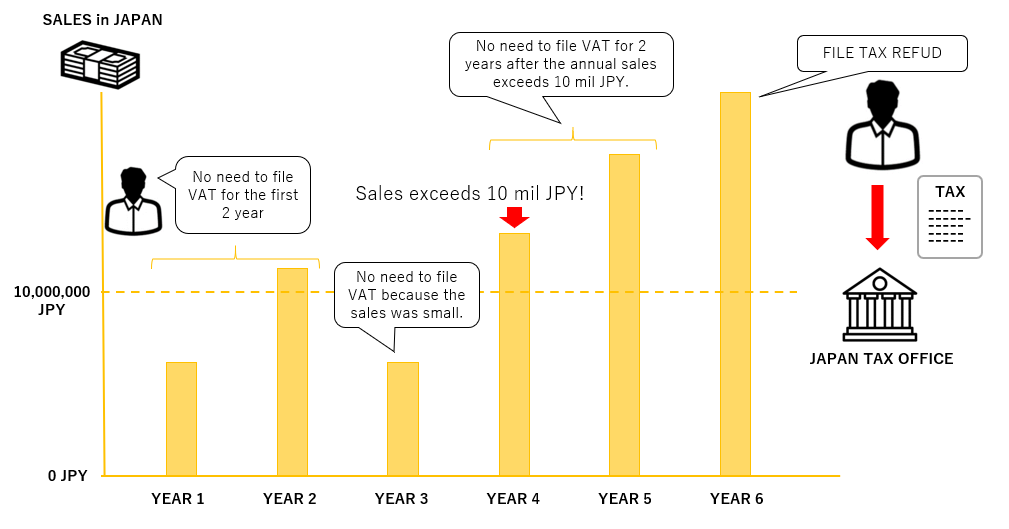

This starts at least 2 years after you start selling in Japan. Any newcomers are given allowance of the first 2 years and until their sales exceeds 10,000,000 JPY. Thus, VAT on sales does not have to be filed or paid for at least 2 years. Also, small businesses with annual sales of less than 10,000,000 JPY can keep and take the VAT as tax benefit that they receive, and do not need to file or pay the VAT to the tax office.

Don’t forget to keep the accounting record. Once your business grows and your sales goes over 10,000,000 JPY, you are required to submit annual report to Japan Tax Office.

When you file the VAT, you need to appoint a tax manager in addition to the ACP. This role is often provided by international tax accounts in Japan.

You can learn what specific documents Japan Tax Office requires you to keep at Point 5 of the section Non-Resident Importers' Responsibilities of our website.

Tax Refund

Importers can use the benefit of the tax refund mentioned in Point 3 above, which is to pay the balance between the VAT they have received and VAT they have paid.

There is basically no other refund of the import duty and tax that you paid.

Contact Us for Any Questions

お気軽にお問合せください

Call Us at お電話でのお問合せ

Contact us 24 hours via the form below.

問合せフォームは24時間受け付けております。お気軽にご連絡ください。

Updates 新着情報

2025年10月12日の輸入申告項目の追加に従い、記載内容を一部更新しました。

2023年10月1日の関税法基本通達改正に従い、記載内容を一部更新しました。

Our column page “Customs Specialist Eyes” is updated.

コラムを更新しました。

Our column page “Customs Specialist Eyes” is updated.

コラムを更新しました。

We’re now on Amazon SPN/Service Provider Network.

当ページ運営会社が、Amazon SPN(サービスプロバイダーネットワーク)に登録されました。

ホームページを公開しました